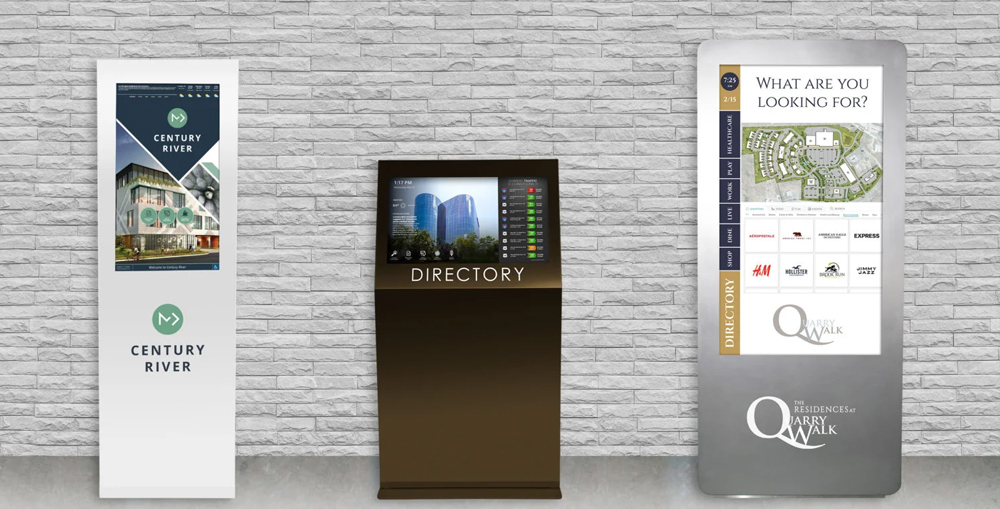

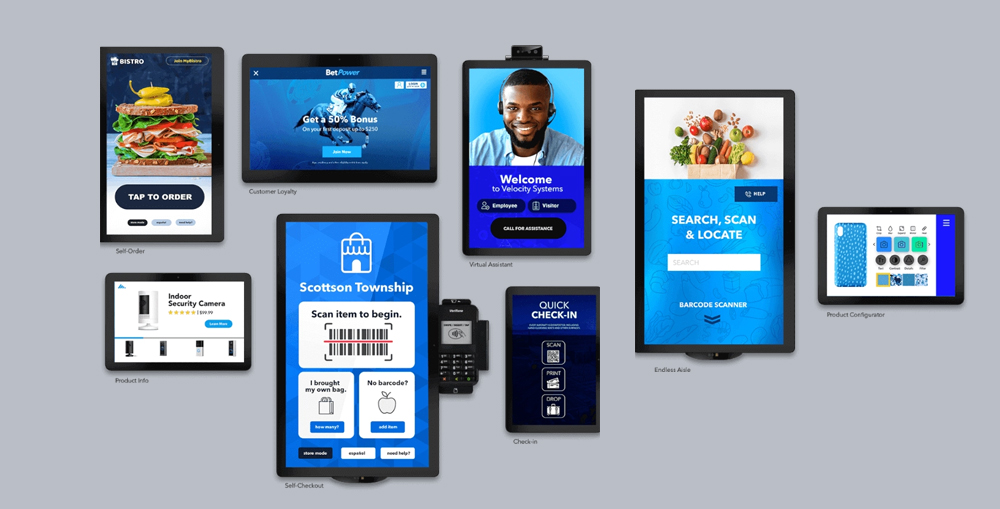

Self-service kiosks have rapidly gained prominence across industries as businesses strive to optimize customer journeys. Customer satisfaction is paramount, driving the adoption of innovative technologies and solutions. Interactive self-service kiosks have emerged as a global trend, undergoing significant evolution over the past decade. Today’s advanced kiosks can handle complex tasks with ease. Payment kiosks, in particular, are enhancing customer experiences through personalized, intuitive interfaces and expedited transactions. Businesses are rapidly adopting to payment kiosks and also customizing these devices as per their unique business needs. A customized payment kiosk tend to align well with business needs and ensure more control and flexibility with lesser operational cost.

Artificial intelligence (AI) is revolutionizing the industry, surpassing traditional software capabilities in managing complex operations. AI’s superior intelligence enables real-time decision-making based on diverse data inputs. By analyzing historical data, customer behavior, and demographics, AI empowers businesses to deliver exceptional personalized experiences, a key driver of overall customer satisfaction. AI-powered payment kiosks not only elevate customer satisfaction but also streamline operations, reduce staffing demands, and boost profitability. In this blog we will discuss how integrating AI into payment kiosks can redefine customer experiences.

See Also: What is a Bill Payment Kiosk: Everything You Need to Know

Integrating AI in Payment Kiosks for Enhanced User Experience

What is AI (artificial intelligence) and how it is Applicable to Payment Kiosks?

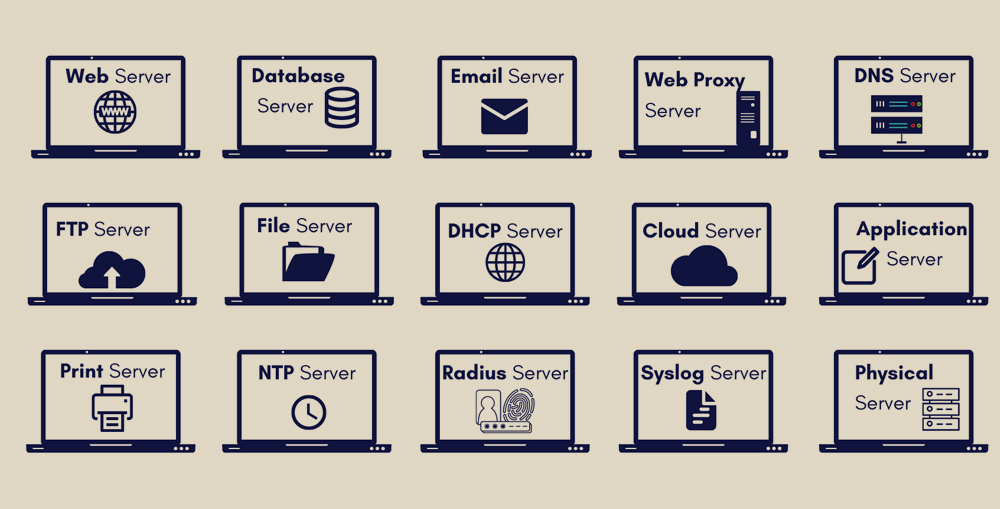

Before we dive into the topic, it is also important to understand the AI (artificial intelligence) and how does it work. Basically the AI or artificial intelligence is a highly sophisticated and complex form of computer program which is designed to simulate or mimic the human intelligence in computer. The traditional software application fell short when it comes to handle complex tasks. However, the AI or artificial intelligence is far superior then the conventional software applications, it is capable of making decisions in real-time. The AI have various features such as natural language processing (NLP), machine learning (ML), and its remarkable capabilities to process and analyze large volume of data.

The AI (artificial intelligence) has a wider spectrum of applications, ranging from smartphone to weather modeling and large-scale applications. The AI is reshaping the entire technology world. When it comes to the role of AI in payment kiosks, the AI is proven to be great at enhancing user experience, optimizing the workflows and boosting the cyber security. The AI has capabilities to collect highly accurate business intelligence data which help businesses acquire deeper understanding of customer behavior and their needs. This information help businesses customize and optimize features that resonate well with the customer needs and expectations.

See Also: Customizing Payment Kiosk Solutions for Different Industries

What is AI (artificial intelligence) and how it is Applicable to Payment Kiosks?

What are the Benefits of Integrating AI in Payment Kiosks?

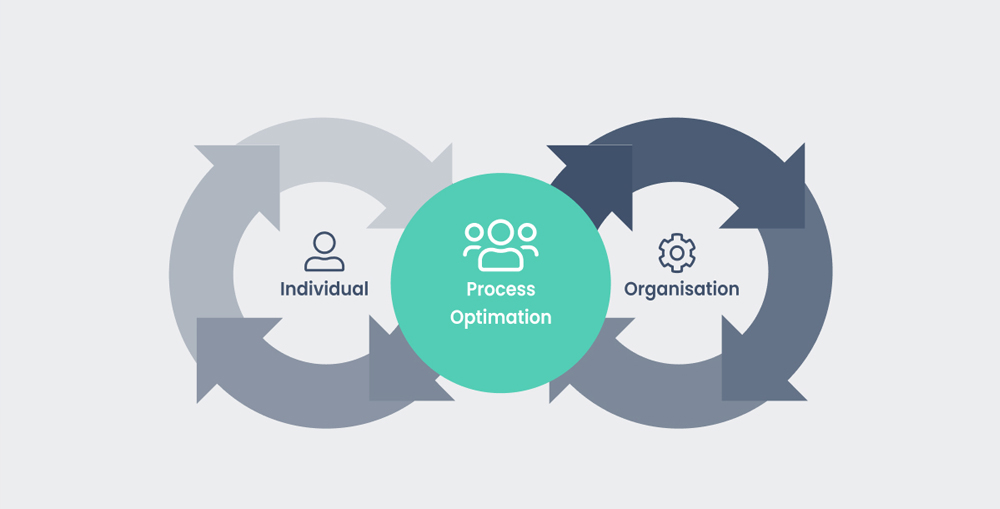

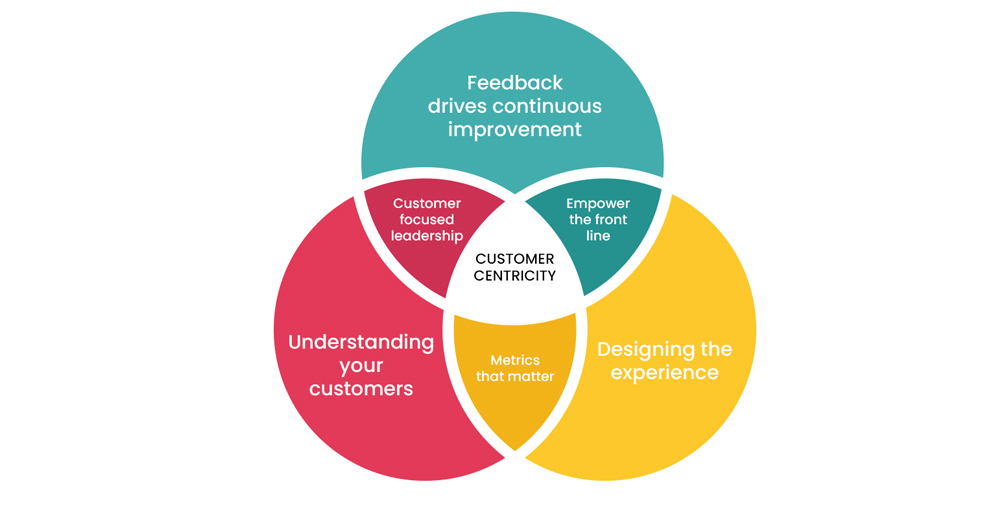

Integrating the AI in payment kiosks comes with various benefits, the most significant is the elevated customer experience. Furthermore the AI integration also improve internal processes and provide much deeper and accurate insights which greatly help businesses improve customer experience. Here are some key benefits of integrating AI in Payment kiosks:

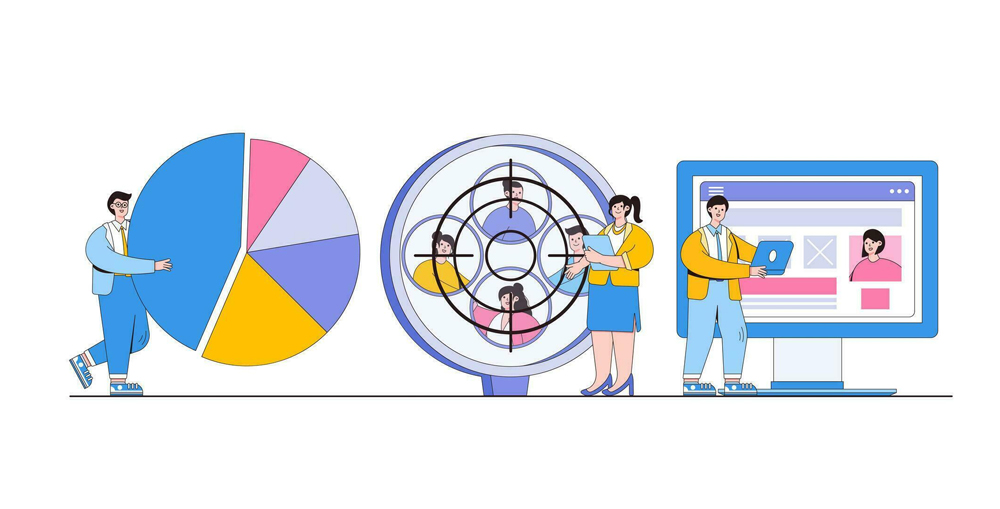

- Personalized Experience: The AI-powered payment kiosks can offer superior personalized customer experience. The AI can analyze the historical data, customer preference, past interaction details and it can understand customer persona, which enable payment kiosks to offer personalized features, products, suggestions and information.

- Voice Commands: The natural language processing (NLP) is the most prominent feature of AI. The NLP allow AI-powered tools and software to take user’s voice commands. This help improving the customer interaction and raise customer satisfaction. The voice commands not only elevate experience but also increase system accessibility.

- Faster Transactions: The AI-powered interactive self-service payment kiosk offers faster transactions. With personalized features, multi-lingual interfaces and intuitive functionalities enable quicker and faster transactions. Faster transactions reduce customer wait time and raise customer satisfaction.

- Higher Accuracy: The human errors causes customer frustration and unwanted delays in the customer service. The human errors are common in traditional service centers. However, with the AI powered payment kiosk automates several service processes which reduce human errors and raise customer satisfaction.

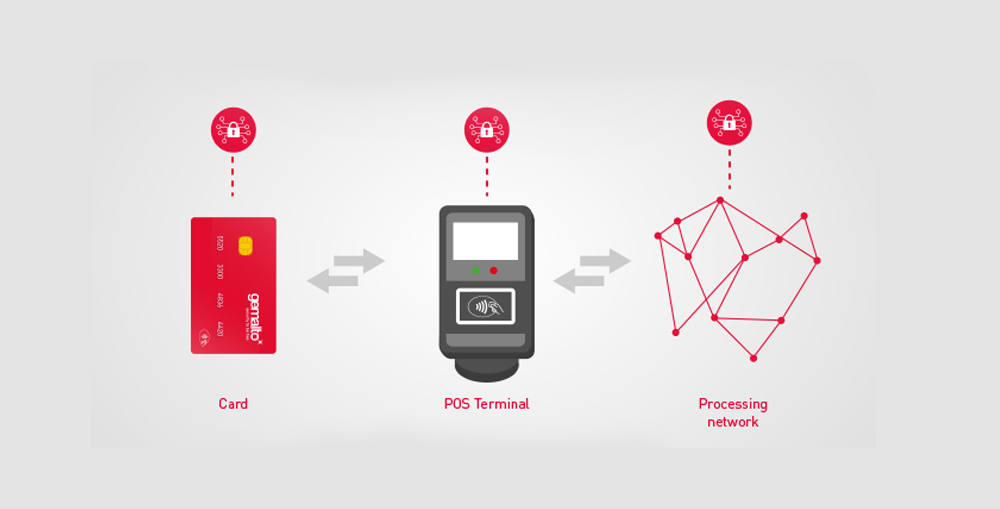

- Higher Security: The AI-powered interactive payment kiosk can greatly improve the cyber security. The AI can offer advanced security features such as facial recognition, biometrics and various management tools which not only strengthen the security but also provide real-time monitoring and higher capabilities to mitigate cyber threats.

- Predictive Analysis: One of the greatest feature of AI is its ability of predictive analysis. The AI has capabilities to process large volume of data which enables it to make highly accurate forecasts and advanced predictive analysis. These analysis help businesses further personalize customer interaction and improve their operational performance.

- In-depth Insights: The AI has capabilities to collect data from multiple channels and perform advanced analysis which enables it to identify correlations, patterns, and trends which are difficult to identify by humans. This in-depth insight help businesses improve customer experience and identify areas of improvement in customer journey.

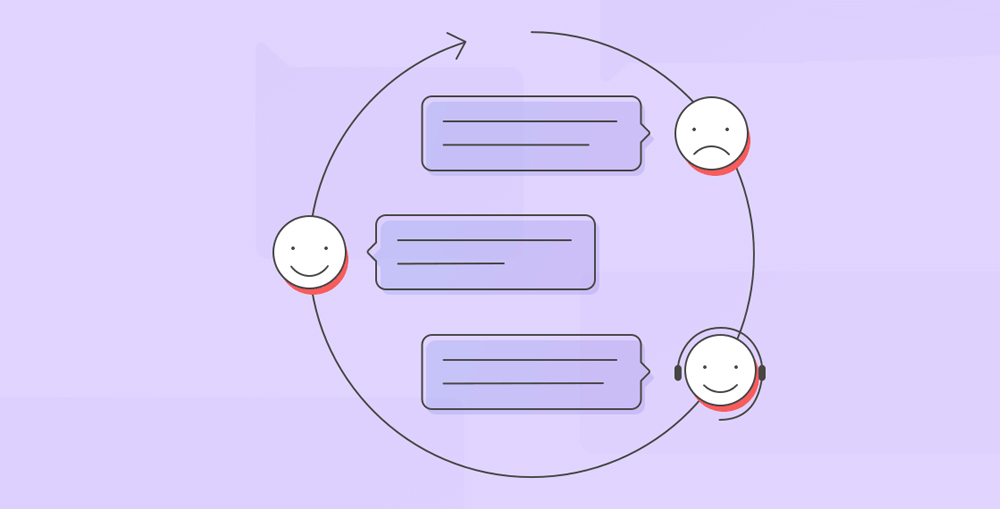

- Higher Accessibility: The AI-powered payment kiosks can offer higher accessibility with intuitive multi-lingual user interfaces and advanced features for the people with special needs. The voice commands and screen-readers help users with special needs. Businesses can also integrate the customer service center with in the kiosk for better customer experience.

Integrating the AI in payment kiosks help elevating customer experience and raise efficiency. Businesses can greatly improve their internal processes as well. The AI has smart algorithms which can analyze data in real-time and take real-time decisions, this is a very useful feature to elevate security and introduce anti-fraud features within payment kiosks and other self-service payment channels. The AI has ability to improve each and every aspect of the customer experience and also help businesses to continuously analyze and improve their payment kiosks and service mechanisms.

See Also: The Future of Contactless Payments in Kiosk Technology

What are the Benefits of Integrating AI in Payment Kiosks?

The Future of AI-Driven Payment Kiosk and Solutions

The AI is rapidly gaining popularity. Businesses operating in Dubai, Sharjah, Abu Dhabi and other regions of UAE often thinks tha the AI is something very expensive and futuristic. However, that is not true, the AI has become the reality of the modern business landscape. It is relatively expensive for very small businesses but not as that expensive. Small businesses can even leverage various AI tools by simply tapping into their cloud with nominal subscription cost. However, for businesses and enterprises the AI-powered solutions are the future. The fundamental need arises at the decision making processes and customer experience management processes. These are the two most important business functions as well and the AI has potential to completely transform these two business functions.

See Also: Analyzing the Impact of Payment Kiosks on Consumer Behavior

The AI is a very powerful technology and it has potential to replace all traditional interactive kiosks in coming future. We have a lot of different businesses who are expected to shift on AI-Driven payment kiosks in future such as restaurants, retails, airports, hospitality, shopping malls, theaters, health facilities, utility services, government and public offices, etc. Furthermore the AI has capability to transform a tradition interactive self-service kiosk into a personal assistant who knows your needs and problems and can resolve them. This can add great value to customer experience while effectively raising their satisfaction and overall business efficiency.

The AI-powered payment kiosks and other solutions offer superior management tools and help boosting staff performance too. All these features make AI more appealing for businesses and we are most likely to see more AI application in coming years. Furthermore the AI technology is also available in open-source which is increasing its reach and attracting more vendors and software development agencies to integrate AI into their customized software and kiosk solutions. All these are indicating a great future for the AI-powered payment kiosks and other interactive solutions.

See Also: The Integration of Mobile Payment Options in Kiosk Systems

The Future of AI-Driven Payment Kiosk and Solutions

Conclusion

Integrating AI in Payment Kiosks is not another technology upgrade, but it is a leap forward towards a more efficient, effective, secure and customer-centric future. By leveraging the superior intelligent and smart algorithms of AI (artificial intelligence) businesses can greatly improve their internal processes and digital solutions. Whether it is a payment kiosk or any other ordinary interactive self-service kiosk, the AI has ability to greatly elevate the customer experience and operational efficiency. One of the biggest advantage of integrating AI in payment kiosk is its advanced capabilities to delivery highly personalized customer experience. The AI can analyze and understand historical data, it can analyze customer preference, their previous interactions and individual needs, which enables it to deliver highly personalized customer experience which raise customer satisfaction and loyalty.

Moreover the AI-powered payment kiosk can offer multi-lingual user interfaces (UIs) which makes them ideal for businesses in Dubai, Sharjah, Abu Dhabi and other regions of UAE. The AI powered interactive self-service kiosk can offer multilingual Chatbots and Virtual Assistants which can exceptionally elevate customer experience. The AI’s role is not only limited to frontend but in the backend systems, business management tools, and the entire information infrastructure can be enhanced and elevated with the integration of AI and its various applications. The AI not only eliminate fraction from customer journey but it also enhance the security of the payment kiosk. All these features and applications are indicating a great future for the AI-powered payment kiosks and other interactive solutions.

In this blog we have discussed the role of AI in the payment kiosks and its various benefits. We also discussed how AI-powered payment kiosks can deliver superior and much more satisfactory customer experience. If you want to learn more about the subject of if you want our help to design and implement a bespoke AI-driven solution or AI-powered payment kiosk for your organization, please feel free to contact us through our Contact Us page or leave a comment in the comment box below and we will get in touch with you soon.

See Also: What are the Features of a Best Self-Service Payment Kiosk Software?

See Also: The Role of Payment Kiosk in Streamlining Retail Transactions

See Also: How Can Businesses Benefit From Self-Service Payment Kiosks?