In the modern era where the customers put convenience on top and consider experience equal to the quality and value. It is extremely important for businesses to come up with new and innovative methods to modernize service delivery process and ensure customers are having a satisfactory experience. Businesses in Dubai, Sharjah, Abu Dhabi and all around the UAE are rapidly adopting self-service technologies to meet the ever growing customer demands. That is not all the self-service technologies are also great at making internal business processes seamless, offering higher productivity and enabling them to achieve higher operational performance.

High performing operations and efficient teams are a key to long term success and higher profitability. The interactive self-service kiosks are a great tool to enable self-service and achieve higher customer satisfaction. A self-service kiosk is a computer terminal with a touch-screen based interactive UI (user interface) and a powerful software engine. Similarly the self-service payment kiosk is also a computer terminal with interactive touch screen and backend software but it have some additional components such as a secure payment terminal and cash accepting device which enables it to support multiple payment methods and a very convenient customer experience.

What Is a Self-Service Payment Kiosk? Unveiling the Future of Transactions

What is a Self-Service Payment Kiosk?

A self-service payment kiosk by definition is a computer terminal with interactive UI and ability to accept payment via various compatible methods which enable users/customers to perform a variety of financial transaction via a seamless self-service experience. The interactive touch screen serves as the main interface to allow users to communicate with the system. Customers can easily navigate through various options available to them via the touch screen and they can chose their required service and make the transaction in a few simple steps.

The on-screen instructions, access to knowledgebase, information and even to customer support help customers guiding their way. The self-service kiosks comes with various payment options and several features which businesses can utilize as per their needs. For example, the kiosk can support payment via cash or coins along with integrated payment gateways, credit/debit card POS terminal and in some cases via NFC to support more modern digital payment methods. All the transactions are recorded along with valuable analytical data which can be accessed through the backend software dashboards.

See Also: What is a Bill Payment Kiosk: Everything You Need to Know

What is a Self-Service Payment Kiosk?

The user interfaces are usually designed with in-built support for multiple languages and on-screen instructions are provided to take customer through the process. Businesses can also use authentication methods such as Emirates ID scanner, QR Scanner, Barcode Reader, Biometrics Reader, headset/intercom, CCTV security cameras, specialized body frame with added physical security and anti-theft features and much more. The self-service payment kiosks are mostly used indoors while deploying self-service payment kiosks in outdoor is also getting popular.

The major difference between the indoor and outdoor self-service payment kiosks is the physical body and weather proofing, the outdoor ones come with several additional features to be able to work outdoor. Usually the outdoor self-service payment kiosks comes with additional weather proofing frame, specialized paint, strong frame, in-built AC or temperature regulatory mechanisms and with much brighter screens. These additional features ensure your self-service payment kiosk can operate seamlessly in harsh environment of UAE.

See Also: How Can Businesses Benefit From Self-Service Payment Kiosks?

The self-service payment kiosks are mostly used indoors while deploying self-service payment kiosks in outdoor is also getting popular.

Key Features and Capabilities of Self-Service Payment Kiosk

The self-service payment kiosks are available in different shapes and sizes. Businesses can also have customized design to include innovative features as per their needs. However, in general there are three major sections of an interactive self-service payment kiosk:

- Intuitive User-Friendly User Interface (UI)

- Secure Payment Terminal and Cash Acceptor

- Backend Software or Server-side Software App

Apart from that several other features can be added, such as ability to sign-in or ability to scan documents and print receipts, etc. All such features depends on the application and business requirements. For example, if a self-service payment kiosk is deployed to collect charity, then it might only have a simple interface with limited information and ability to pay via cash or credit/debit card.

The users doesn’t have to sign-in, they can simply chose the amount select the charity purpose and good to go. However, if a self-service payment kiosk is deployed at a government office, then it might have to let users sign-in via their Emirates IDs, username, or anything else. The user might also have to scan various documents and they could also be needing to print some documents, vouchers, payment receipts, etc. Therefore all such features are based entirely on business needs.

See Also: What Is a Self-Service Payment Kiosk? Unveiling the Future of Transactions

Key Features and Capabilities of Self-Service Payment Kiosk

Intuitive User-Friendly User Interface (UI)

For any system or application the user interface or UI is the most important aspect. It is where the customers actually interact and communicate with the system and how this interaction goes will pretty much determine the customer satisfaction. A user-friendly user interface (UI) is a must. The self-service payment kiosks are usually offered a broader audience. As in UAE there is a large expat population so adding English along with Arabic and few other languages could greatly improve user experience.

Another important aspect of the user interface (UI) which makes it user-friendly is the navigation and information structure. In order to perform a certain task, a customer might have to go through several steps, he/she would be needing to input some information or chose from the available menu/options and they might be needing some on-screen instruction or help.

Therefore all such processes and tasks are divided into several screens so the customer can complete a task in simple and easy-to-understand steps. Ability to contact customer support team or to access the onboard knowledgebase can further enhance customer experience. All these and several other such feature can help making UI intuitive and user-friendly.

See Also: The Evolution of Payment Kiosk from Cash to Digital

Intuitive User-Friendly User Interface (UI)

Secure Payment Terminal and Cash Acceptor

The self-service payment kiosk handles the most personal and valuable customer data which could include their Emirates ID, credit/debit cards, logins, biometrics, other important documents and much more. All these information are very sensitive and extremely important. Therefore the importance of security and data protection measures is paramount.

Furthermore the customers too concerns a lot about their financial and personal data. Adding authentication, encryptions and network security protocols is a must to have feature with advanced self-service payment kiosks. The server-side application, the POS, and the customer terminal (interactive self-service payment kiosk) all must have to be protected with adequate security measures and multi-layer protective IT infrastructure.

In case of cash acceptor, the kiosk will be able to accept currency notes and in some cases it also accept coins. Therefore it is important to use high-quality cash acceptor with advance authentication technologies to authenticate and identify the currency notes and coins with utmost accuracy. A secure payment terminal and cash acceptor will ensure customers’ trust and satisfaction.

See Also: How to Choose a Right Self-Service Payment Kiosk for your Business?

Secure Payment Terminal and Cash Acceptor

Backend Software or Server-side Software App

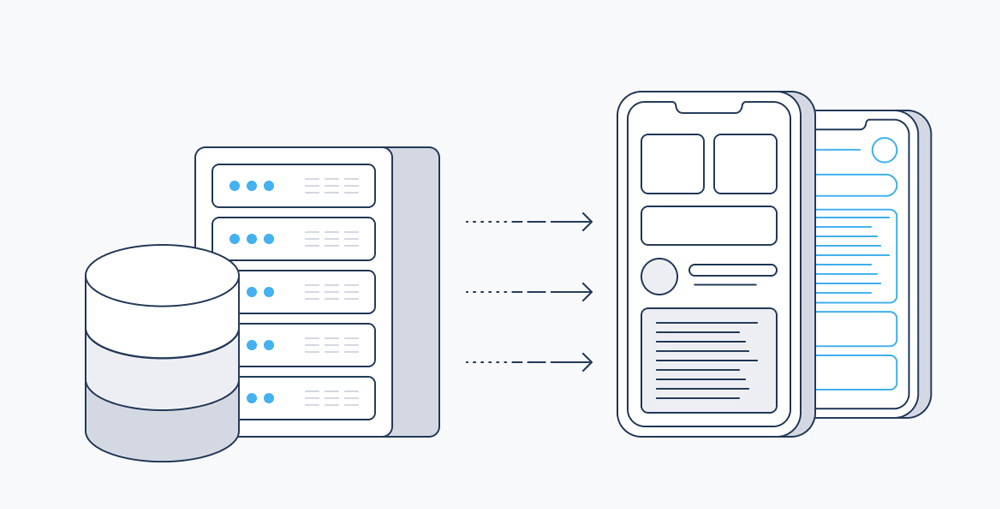

A backend software of server-side software app is basically the brain of the entire self-service payment kiosk system. It is a server-side application which is usually hosted on cloud or on-premises data center and all self-service payment kiosks are connected to it via network. The server-side self-service payment kiosk software runs all the algorithms which runs in the background to execute each and every function and let the customers perform the tasks they want. It connects various different systems, databases, and tools to provide an intuitive user experience.

The backend software is also responsible for managing the information, maintaining the logs of transactions, and enabling communication between essential components to facilitate a transaction through the self-service payment kiosk. When a user gives an instruction through the interactive self-service payment kiosk the backend software retrieve and store information in its databases and other connected systems which ensures a proper execution of the instruction given by the user and then it returns the results such as printing the payment receipts, etc.

See Also: Analyzing the Impact of Payment Kiosks on Consumer Behavior

Backend Software or Server-side Software App

Every business have different requirements, for example, a self-service payment kiosk deployed at a restaurant would be different from a self-service payment kiosk at a hotel or at a government service center. Therefore different businesses needs different features to accommodate their business processes. The backend software or server-side payment kiosk app is designed and configured differently for each business or service. For that the self-service payment kiosk is connected with different peripherals such as Emirates ID Reader, Thermal Printer or Receipt Printer, Document Scanner, Passport Scanner, Document Printer, Entry-Pass/Badge Printer, Biometrics Scanner, IRIS or Retina Scanner, VoIP, and many more.

Apart from peripherals the self-service payment kiosk’s backend software also requires integration with other databases, third-party systems and central information system. These integrations allow the self-service payment kiosk to incorporate necessary features and functionalities. The backend software of self-service payment kiosk can be customized too to include required features and functionalities.

The server-side self-service payment kiosk software runs all the algorithms which runs in the background to execute each and every function and let the customers perform the tasks they want.

Businesses can customize the backend software as well as the self-service payment kiosk itself to align it with their unique business needs. Businesses should chose the backend software carefully while carefully considering their current needs and future expectations along with its ability to customize and scale to adjust with ever changing and growing business needs.

Benefits of a Self-Service Payment Kiosk

There are several benefits of self-service payment kiosk, but the biggest advantage is to offer more freedom, control and easy access to the customers. By allowing customers to approach a self-service payment kiosk 24/7 offer them freedom and convenience. Furthermore businesses can offer a personalized customer experience and raise customer satisfaction which is a key to long-term success. Here are some key benefits of a self-service payment kiosk:

- A self-service payment kiosk allow customers to perform tasks and make payments independently, without involving any staff. This gives them a sense of control, freedom and privacy. The intuitive UIs ensure a smooth and seamless customer experience which raise customer satisfaction.

- The self-service payment kiosk can save tons of resources, as it offers an alternate and more quick service channel, most of the customers prefer to go with the self-service instead of waiting in long queues, thus it not only facilitate customers but also lift a lot of workload from the staff and improve their productivity and efficiency.

- A self-service payment kiosk can operate 24/7, it is fully automated, thus doesn’t require staff’s presence. It saves time and resources and offers a greater ROI comparing to traditional service methods. Furthermore the operational and maintenance cost is extremely low comparing to a traditional service center.

- The self-service payment kiosk doesn’t only support transactional tasks, but it can offer a variety of services such as wayfinding, accessing information and knowledge base, facilitating communication, delivery targeted content to audience, collecting customer feedback data along with a wealth of business intelligence data and much more.

- As the customers are involved and participating in the entire process, the customer engagements are higher comparing to traditional service counter. Furthermore the customers can chose directly from the kiosk what they need, they can explore other available options and access information which reduce the chance of errors and it greatly enhance customer experience.

The self-service payment kiosks offer a personalized and rich experience which raise customer satisfaction. Furthermore businesses can remotely manage these kiosks which makes maintenance or updating information seamless. The self-service payment kiosks are also very cost-effective and doesn’t require much maintenance which raise their ROI. Businesses can use these kiosks for many years, and can extend their lifecycle by making simple upgrades which keeps them relevant for many years. The self-service payment kiosk is a win-win deal for both business and customers.

See Also: Self-Service Kiosks in Retail: Revolutionizing the Shopping Experience

Benefits of a Self-Service Payment Kiosk

Conclusion

The self-service payment kiosk is a marvel of technological advancements and modernization of the business landscape. Businesses and organizations in Dubai, Sharjah, Abu Dhabi and all around the UAE are proactively seeking ways to modernize their methods and business processes to maximize efficiency, productivity and performance which ensures high-quality service and products. The importance of customer satisfaction is paramount, the customer satisfaction drives customer loyalty which provides the foundation from where business can built success and achieve their long-term goals.

The interactive self-service payment kiosks has evolved from simple vending machines in to a full-fledged virtual service center, including all the important ingredients of a traditional service center which assure customer satisfaction. The rapid growth and great success of the interactive self-service payment kiosks is a strong indication of their role and significance in the future business landscape.

The self-service technologies, especially the self-service payment kiosks will undoubtedly play a significant role in reshaping the methods and processes of financial transactions between businesses and consumers. In this blog we have briefly discussed the key components, working and benefits of a self-service payment kiosk. If you want to learn more about the subject or if you want our help to deploy a custom self-service payment kiosk solution for your business, please feel free to contact us through our Contact Us page or leave a comment in the comment box below and we will get in touch with you soon.

See Also: What is Money Transfer Kiosk?

See Also: Modern Technologies to Make Your Exhibition Booth Stand Out