Imagine life without cash where payments are just a tap away! With the rise of cash-less life-style, wider use of credit/debit card in our daily transactions, and huge adaptation of smart technologies is completely reshaping the way businesses are conducting transactions with consumers on daily bases. The contactless payment is a standalone innovation which can deliver exceptional customer experience. Just a few years back during the pandemic the contactless technology’s popularity soared. Since then the consumers now praise the convenience and security of digital channels, driving a shift away from traditional cash.

In the most recent technology blackout/disruption amid the Crowdstrike and Microsoft software shutdown, we realized how dependent we are on credit/debit cards and smart payment methods. These all factors contributes to huge rise in payment kiosk adaptation all across the world. Businesses across the UAE, from Dubai to Abu Dhabi, are embracing interactive self-service kiosks to streamline operations and to enhance customer experiences. Businesses are eager to align themselves with customer needs and desires, the contactless payment is one of the emerging trend all across the world.

Consumer psychology also plays a pivotal role in this transformation, with most of the customers preferring contactless options over germ-laden currency bills. In this blog, we’ll discuss the future of contactless payment in kiosk technology and its potential benefits for businesses.

The Future of Contactless Payments in Kiosk Technology

What is Contactless Payment Technology?

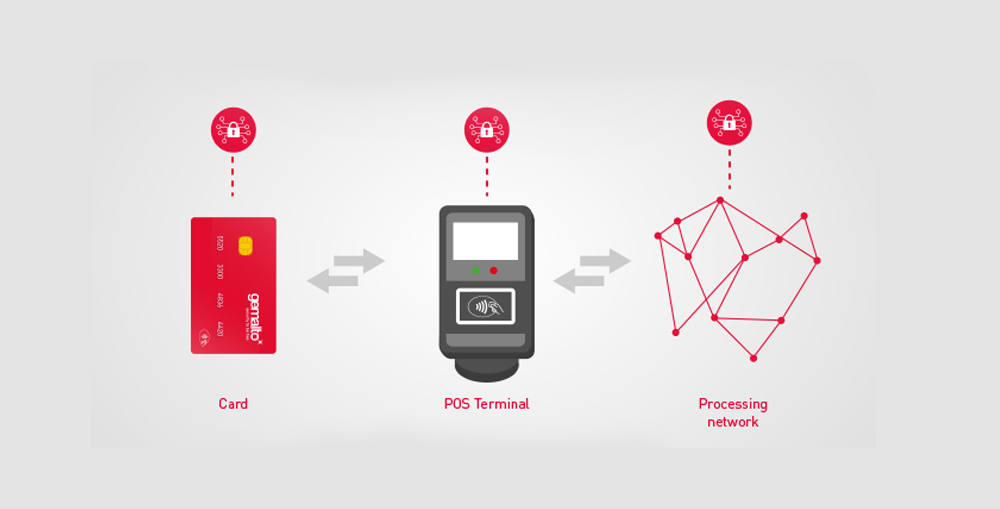

Before exploring the advantages of integrating contactless payments into interactive self-service kiosks, let’s understand the basics of contactless technology. This technology primarily relies on radio frequency-enabled chips, which can be found in NFC-enabled credit/debit cards, EMV-integrated chips, or RFID (radio frequency identifier) enabled smart devices. Contactless payment is achieved through secure, wireless data transmission between your device or credit/debit and a payment terminal. The most common form of contactless payment is “Tap and Pay” cards, which are typically NFC-enabled credit/debit cards used at NFC-compatible point of sale (POS) terminals.

NFC-enabled smartphones have played a crucial role in the contactless payment revolution. Over the past decade, the global NFC market has grown tenfold, now valued at an impressive $40 billion. Today, almost all major smartphone brands, including Samsung, Apple, Huawei, Sony, Motorola, and Xiaomi, integrate NFC technology into their new devices. In fact, about 94% of all smartphones produced last year featured built-in NFC technology. Due to advancements in operating systems and security protocols, these devices have become the preferred choice for modern consumers making contactless payments. That is why it is important for businesses to integrate contact less payments in their self-service payment kiosks.

See Also: How Can Businesses Benefit From Self-Service Payment Kiosks?

What is Contactless Payment Technology?

The Role of Contactless Payments in Modern Self-Service Payment Kiosks

The self-service interactive kiosks are widely used by retail and service sector. Whether it is transport, airports, educational institutes, retail stores, government services, private service sector, banks, or any other industry the interactive self-service kiosks are paving way for the modern and digitally transformed society. The interactive self-service kiosks are not ordinary computer terminals, but have potential to delivery most sophisticated and complex services via an intuitive and enhanced self-service customer experience. The contactless payments can be integrated within a modern payment kiosk along with the more traditional cash payment methods.

According to studies more than 70% of the customers prefer to checkout through self-service payment kiosks instead of traditional cash counters. That is why integrating contactless payments could greatly enhance the customer experience at a very large scale. Imagine being at a shopping mall’s food court or a movie theater, where usually you have stuff in your hands, and you have to make a payment! Either it is through cash counter, or depositing cash in a payment kiosk or you just have to tap your credit/debit card, smartphone or even smart watch. Which will you prefer? Obviously the contactless payment is much more convenient and quicker.

That is why integrating contactless payment can greatly elevate customer experience and help optimizing the operational efficiency as well.

See Also: What are the Features of a Best Self-Service Payment Kiosk Software?

The Role of Contactless Payments in Modern Self-Service Payment Kiosks

Benefits of Contactless Payments in a Self-Service Payment Kiosk

The consumers are preferring to use their credit/debit cards instead of carrying the cash. Making payment by just a simple tap is much more convenient than carrying cash. When we integrate the contactless payment technology in self-service payment kiosks we can greatly enhance their efficiency and customer experience. Here are a few benefits of integrating contactless technology in interactive self-service payment kiosks:

- Quicker Transactions: The customers can pay in seconds with contactless payment. Which speedup service delivery, reduce customer wait time, and results in happier and satisfied customers which is great for businesses.

- Improved Hygiene: The contactless payment minimize the physical contact and need to pay by the cash bills, which help increasing the hygiene. Features that align with customer needs and desires result in higher customer satisfaction.

- Improved Security: The contactless payments typically utilize NFC or near field communication technology, which in itself is very secure. The device must has to be in close proximity, and the data is transferred through encrypted mediums which elevates the security.

- Multiple-Payment Options: Another great advantage of contactless payment is that it can offer customer to choose multiple payment methods. The customer can use their credit/debit cards, smartphones, smart watches, digital wallets, etc.

- Minimize Operational Cost: The operational cost is one of the most crucial factor for any business. The contactless payments allow faster transaction, which reduce wait time, enable kiosks to serve more customers, reduce reliance on staff and resultantly minimize the need of staff.

The contactless payment increase service delivery speed, which minimize customer wait time, and help optimizing the operational efficiency. Faster service delivery through the interactive self-service payment kiosks, help reducing the staff workload which improves staff efficiency and minimize labor cost.

See Also: What is a Bill Payment Kiosk: Everything You Need to Know

Benefits of Contactless Payments in a Self-Service Payment Kiosk

Contactless Payment beyond Tapping the Cards

With the advancement in technology and wider adaptation of the self-service interactive solutions, the contactless payments are also expanding. The manufacturers are introducing more technological solutions driving diversity in the contactless payment methods. The future of the payment kiosk and contactless payment is anticipating various trends, some of them are as follow:

- Integration of Mobile Wallets: The well-known wallets such as Google Pay, Apple Pay, and Samsung Pay allow customers to store their credit/debit card in their devices and enable them to pay via their smartphone or smart watch at any NFC enabled payment terminal (POS).

- QR Code Enabled Payment: The QR Codes are popping up everywhere these days. These QR Codes can also be used for contactless payments. The modern smartphones can scan the QR Code which takes them to their wallet or online link where the payment can be made very quickly.

- Advanced Security Features: The contactless payment methods are improving greatly and the payment limit, encryption and tokenization are expected to improve significantly in coming future. Which will make contactless payment more secure and foolproof.

- AI-Powered Personalization: The AI (artificial intelligence) integration in contactless payment methods will greatly improve customer experience. It will empower customers and offer better personalization which will increase the accessibility and utility of the contactless payments.

- Biometric Authentication: The biometric will not only make the payment more secure but also quicker. The customers will be soon able to make payments by scanning their finger or simply with facial recognition technology which will make transactions faster and secure.

The contactless payments offer various benefits along with its positive environmental affect. As with the contactless payment the need of paper receipts and cash can significantly reduce which will have positive environmental impact. With the rise of contactless payment methods and interactive self-service payment kiosks the customers will be able to make payments even while being abroad. The currency conversion and transactions fees can be implied automatically without any delay. There are several other trends which are gaining recognition and would result in higher adaptation of contactless payments in future.

See Also: Analyzing the Impact of Payment Kiosks on Consumer Behavior

Contactless Payment beyond Tapping the Cards

Conclusion

As the smartphone and mobile technologies are rapidly evolving, businesses are compelled to adopt digital solutions to better align with the customer needs. The customer experience has become the most crucial aspect in any business’s success. The services and products can be replicated however the service quality and experience is unique to every brand. This is what can be a strong deciding factor for customers. Businesses all across the UAE knows that very well therefore the customer-focused solutions are gaining huge momentum. The contactless payments and the interactive self-service payment kiosks are the ideal companion. The contactless payments can greatly improve the efficiency and impact of the interactive self-service payment kiosks.

As the consumers are praising cash-less lifestyle the future of contactless payments is very promising. The usage of digital wallets, smartphones, NFC enabled devices, QR Code based payments and other contactless payment methods will become standard and norm. Integrating the contactless payment methods in interactive self-service kiosks can greatly improve the customer experience by offering them quicker and secure payments. Where the contactless payments elevating customer experience it also offers multitude of benefits for the businesses. Businesses can greatly improve the operational efficiency and minimize labor cost by implementing contactless payments enabled interactive kiosks.

In this blog we have briefly discussed the contactless payments and their role in interactive self-service payment kiosk. If you want to learn more about the subject or if you want our help to build bespoke interactive self-service payment kiosks with integrated contactless payments, please feel free to contact us through our Contact Us page or leave a comment in the comment box below and we will get in touch with you soon.

See Also: How to Choose a Right Self-Service Payment Kiosk for your Business?